The Neenah City Council and Mayor are committed to supporting business expansion and retaining an environment optimal for corporate success. As part of this effort, businesses can relocate and grow using various education, training, and financial assistance programs. The Community Development staff will assist your company through every step of the incentive process.

Local Incentives

Tax Increment Financing (TIF)

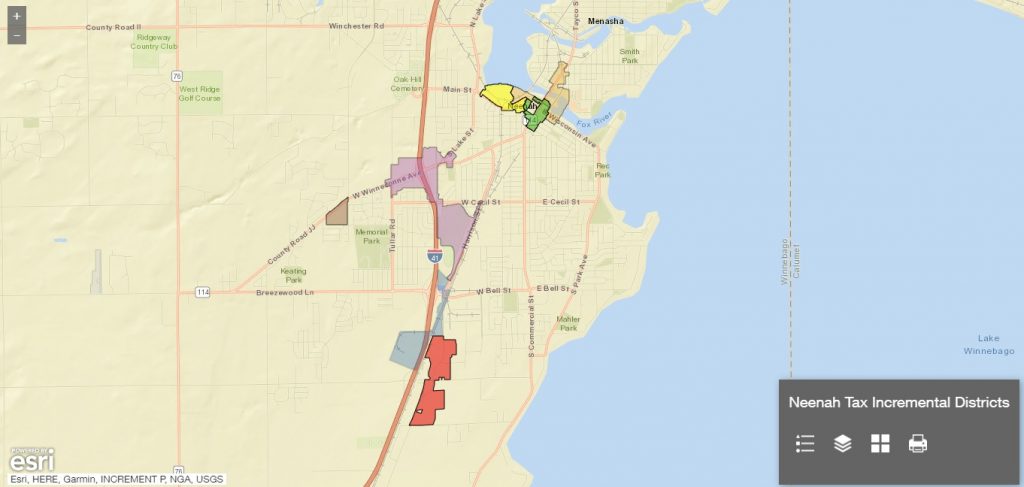

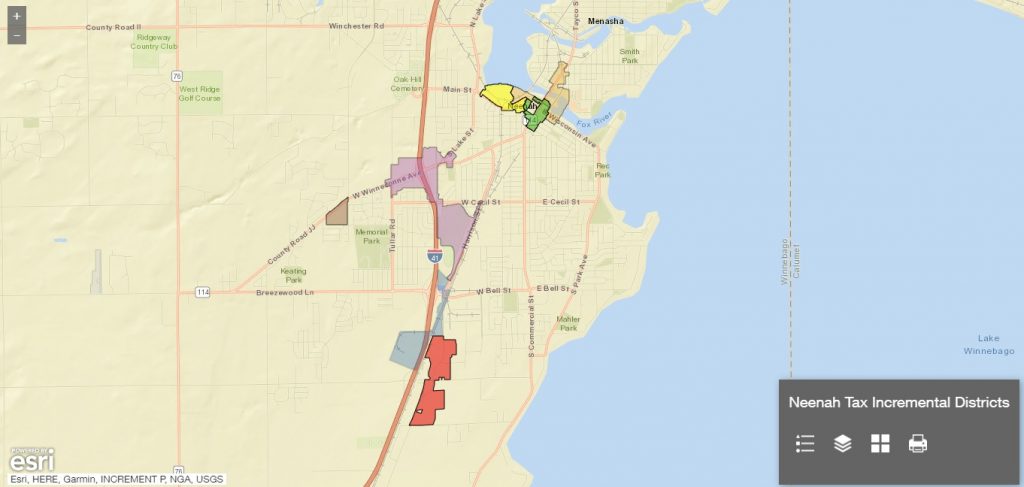

The City’s most effective economic development tool is tax incremental financing (TIF). The use of TIF in the City has helped revitalize Downtown Neenah, created the Southpark Industrial Center business park, supported the development of the Westowne Shopping District, and assisted in the overall growth and development of the City over the last 30 years.

The City currently has 7 active TIF Districts (Click here for an interactive map):

TIF Documents and Informational Links:

TIF Project Plans

2020 Tax Incremental District Analyses and Report

WI DOR Tax Incremental Financing (TIF) Information

Tax Incremental Law – WI State Statutes 66.1105

How does TIF work? Let’s look at a hypothetical example. A large open property is assessed at $100,000. The City invests $1 million in roads, sewers and development assistance so a commercial development can be built with an assessed value of $10 million. All of the property taxes paid on that $10 million new increment goes to pay off the City’s $1 million investment. After the City collects sufficient tax revenues to pay off all the borrowing costs, the taxes generated will be shared with the school district, county and technical college forever, holding down future taxes. In addition, the City helps to create new jobs, new shopping opportunities and brings new homeowners into the community.

- Industrial Revenue Bonds (IRBs). The City of Neenah, via granting from the State of Wisconsin, has the authority to issue tax-exempt bonds on behalf of a business. This valuable program assists small manufacturers with expansion projects through low-interest financing. Even though IRBs are municipal bonds, they are not general obligations of the municipality. The company or business that will use the facilities provides the interest and principal payments on the loan. The local government is in partnership with the business, lending its name, but not its credit, to the bond issue. IRBs are a means of financing the construction, expansion and/or equipping of, primarily, manufacturing facilities. The proceeds of the bond issue may be used to finance the cost of land, construction of new or expanded facilities, purchase of equipment, and the payment of certain costs incurred in the issuance of the bonds. Unlike most conventional loans, IRBs can offer businesses a convenient, long-term, and often a fixed-rate financing package. Similar to other municipal bonds, the interest earned on IRBs is exempt from federal income taxes. As a result, the bond buyer is willing to accept a lower rate of interest in exchange for tax-free income.

- Façade Improvement and Design Assistance Program. The objective of the program is to support private reinvestment in commercial properties in Neenah’s Central Business District and S. Commercial Street corridor and preserve the historic character of storefronts, promote visible improvement that positively impacts the districts, and to increase business in the districts. Eligible projects include replacement/improvement of windows and doors, modifications to entryways to facilitate handicap access, façade treatment of exterior surfaces, and code-compliant signage and awning treatments. For more information on the Central Business District grant please click here. For more information on the S. Commercial Street corridor grant please click here.

- Small Business Loan Program. This program provides low cost, fixed rate financing to small, growing companies that are creating new jobs in Neenah. Loans may be obtained to finance a portion of the cost of fixed asset projects, and are issued by the City of Neenah as a companion to conventional financing. The loans can finance up to 30% of the projects’ total debt, up to $50,000. Terms are a maximum of 20 years on real estate and 10 years on machinery and equipment. For more details on this program see the download, and/or contact the Community Development Department.

For more information, check out these links:

What is TIF?

Top Ten TIF Questions

County Incentives

Winnebago County Industrial Development Board (IDB): The IDB directly administers or has access to economic development programs that financially assist local units of government and business and industry in the county to create and/or retain quality job opportunities, increase the county’s tax base, and to raise the level of income for local residents. Programs include:

- Revolving Loan Fund Program The Winnebago County Revolving Loan Fund Program has provided over $8.3 million in 27 separate loans to local communities for business and industrial development. Businesses interested in benefiting from this program should work closely with their community leaders by requesting them to be the applicant and direct recipient of loan funds.

State Incentives/Financing Programs

- Economic Development Tax Credits. This program allows existing and relocating businesses to earn tax credits for Job Creation, Capital Investment, Employee Training and Corporate Headquarters activities. The tax credits, which are nonrefundable and nontransferable, must be applied against a certified business’s Wisconsin income tax liability.

- Entrepreneurial Development Programs. The Wisconsin Economic Development Corporation offers assistance to entrepreneurs and startups.

- Workforce Training Grants. The Wisconsin Economic Development Corporation offers grants to assist in workforce training.

Local economic development staff can work with the Wisconsin Economic Development Corporation Regional Economic Development Director to provide further information on federal, state, and regional resources to expanding or relocating firms. Together, they can also mobilize resources to help struggling businesses. The WEDC Regional Director for Neenah and the greater Fox Cities area is Jon Bartz, phone 608-210-6846.

Other Business Financing options

Small Business Administration (SBA): The U.S. SBA offers several small business loan programs. For more details on the loan programs, such as the Basic 7(a) Loan Guaranty, Certified Development Company (CDC)/504 and Microloan 7(m), visit the SBA website.

Wisconsin Business Development Finance Corporation – WBD: WBD provides loan packaging and loan services such as finding appropriate and affordable financing, credit analysis, and preparing loan applications. WBD is the primary lender of the SBA 504 loan program.